Pockets Change

Building thriving financial futures through Hip-Hop pedagogy

Our Mission…

Pockets Change's mission is to build thriving financial futures for K-12 students, young adults, and educators through the arts and neuroscience. We see the connection between students’ ability to process their emotions around money while learning complex financial concepts. We use Hip Hop and the arts to show that finance is about more than just numbers, it’s a way to express our rhythm, our habits, and our collective values.

Hip-Hop and Finance in action:

“This curriculum is what finance education needs! My students want to see someone who looks like them, and gets the challenges they are facing, not some other tired lesson. My class lit up when I shared songs from the curriculum, they’re really excited to talk about ways to create change” - Joanna, High School Educator

CHANGING THE WAY FINANCE IS TAUGHT

-

Spotify Playlist

-

Web Comics

-

Money Personality Quiz

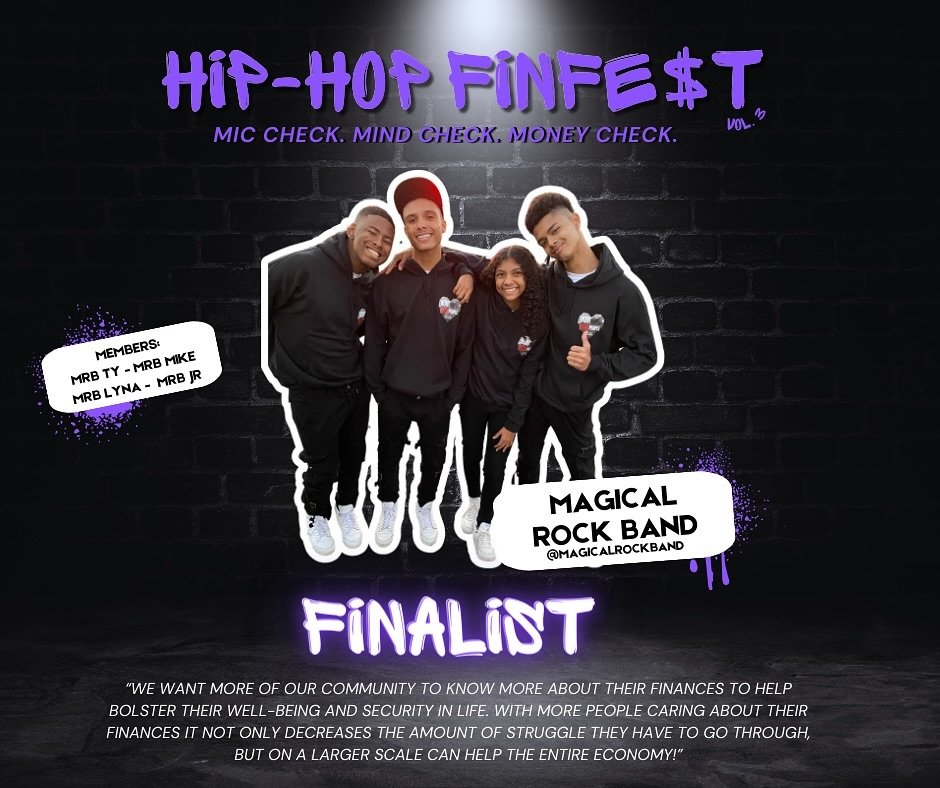

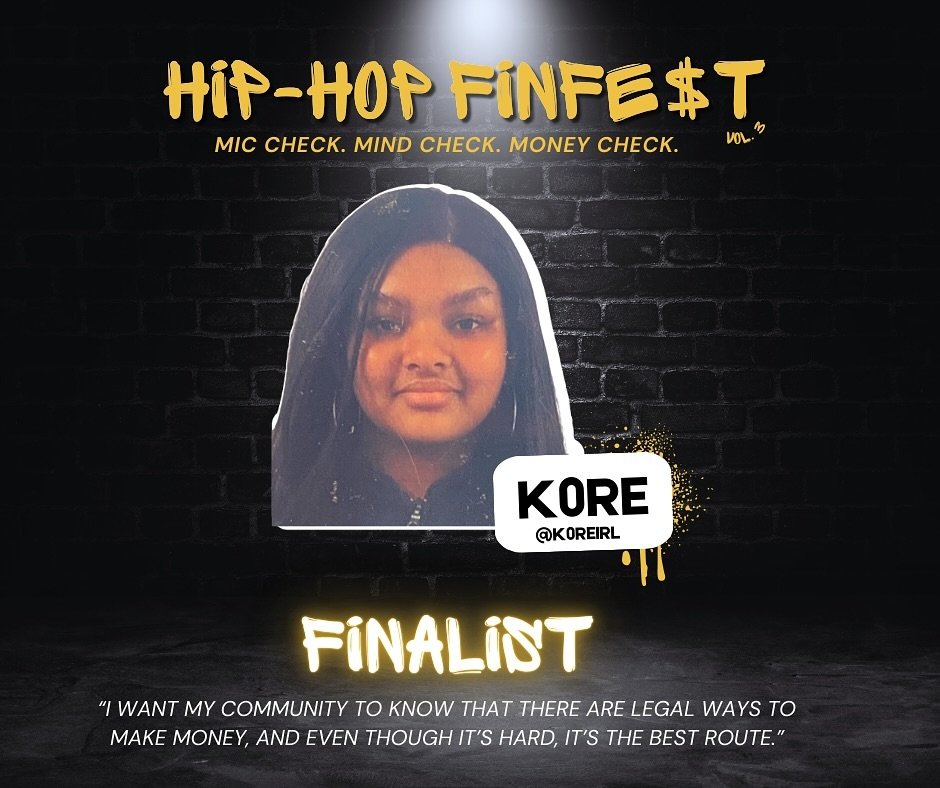

![🚨 Submissions may be closed but the raps never stop! Swipe to see the latest in Hip-Hop FinFe$t news including details about the upcoming Fe$t along with how YOU can view all of the Fe$tivities LIVE! [more details to come on physical location]

___](https://images.squarespace-cdn.com/content/v1/55df795ee4b076ce2ff95cdc/1720808626209-KS30FL6O58F5IJ1NGGS3/image-asset.jpeg)