Financial education is about much more than numbers, it’s a means for self-care and social justice.

Why Hip Hop & Finance?

Hip Hop pedagogy focuses on understanding self-identity in relation to the whole. By connecting Hip Hop and Finance, we develop an understanding of ourselves and our relationship with money. We build financial habits that resonate with our personal identity. We discover how we process information and how to effectively communicate & collaborate. By starting with self-care and personal agency we build our individual capacity to take part in social justice efforts and create change in our lives, our communities, and our world.

Understanding our finances impacts more than our wallets, it gives us the skills to thrive.

Building Financial Resilience Beyond Financial Literacy

5 Steps to Building Financial Resilience

Our framework aligns to the National Standards for Financial Literacy from Jump$tart Coalition for Personal Financial Literacy, the Core Body of Knowledge (Family and Community Relationships), Framework for Great Schools, CASEL Social Emotional Learning competencies, and Aspen Institute 2Gen model of family engagement. Through the 5 components of this framework students, families, and educators view learning as a continuous process that acknowledges and elevates the needs and goals of the whole family and community.

1. Buy-In Conversations: Create the Cypher

Find your why and start making money more approachable. Intergenerational conversations create paths to overcome obstacles, encourage empathy, engage curiosity, deepen relationships and extend learning. Families will determine their money personalities and have facilitated discussions around fears and myths about money. Studies show that parents are more afraid to talk to their kids about money than sex or drugs, so we start here.

2. Examine Systems: Find Shared Rhythm

Discover how financial systems work, acknowledging and discussing the ways systems and institutions present obstacles and opportunities. Cultivate tools for relationship building and community connection. The financial system is often designed to take advantage of the most marginalized communities. We will talk through the most common pitfalls and advantages when it comes to banking, savings, credit and debt, insurance, and taxes in the context of understanding systems.

3.Build Habits: Discover Personal Rhythm

Examine the decision making process and explore ways to build and change habits at any age. Use conversations as a tool to celebrate connection and deepen both self-awareness and community relationship skills. Habits tend to get passed down from generation without questioning them and often the habits that survive do not help us thrive. We will help families discover their existing money habits and give them tools to implement ones that allow them to build savings, pay down debt, and feel in control of their finances.

4. Develop Advocacy Skills: Taking the Stage

Develop skills to communicate and advocate for yourself and others. Integrating ongoing financial education strategies and resources that help students and families thrive in school and in life. Money is the last taboo, so we’re often taught to swallow and hide our financial mistakes. We teach families how and when they can advocate for themselves and their communities, from disputing a charge, asking questions to a banker, increasing their credit score, and negotiating raises and rates. Individual transformation drives system change.

5. Identify Values: Tapping into Your Flow Style

Connect our interests and values to our lifestyle and learning experiences building opportunities for extending learning in everyday moments. The best piece of advice we’ve ever received is where you spend your money is a representation of what you value. We will ask families to examine their spending through a new lens - our Spending Values Matrix. Then we will take them through a budgeting exercise that will allow them to plan for their physical, emotional, and mental needs in a personalized, meaningful way.

What it looks like in action:

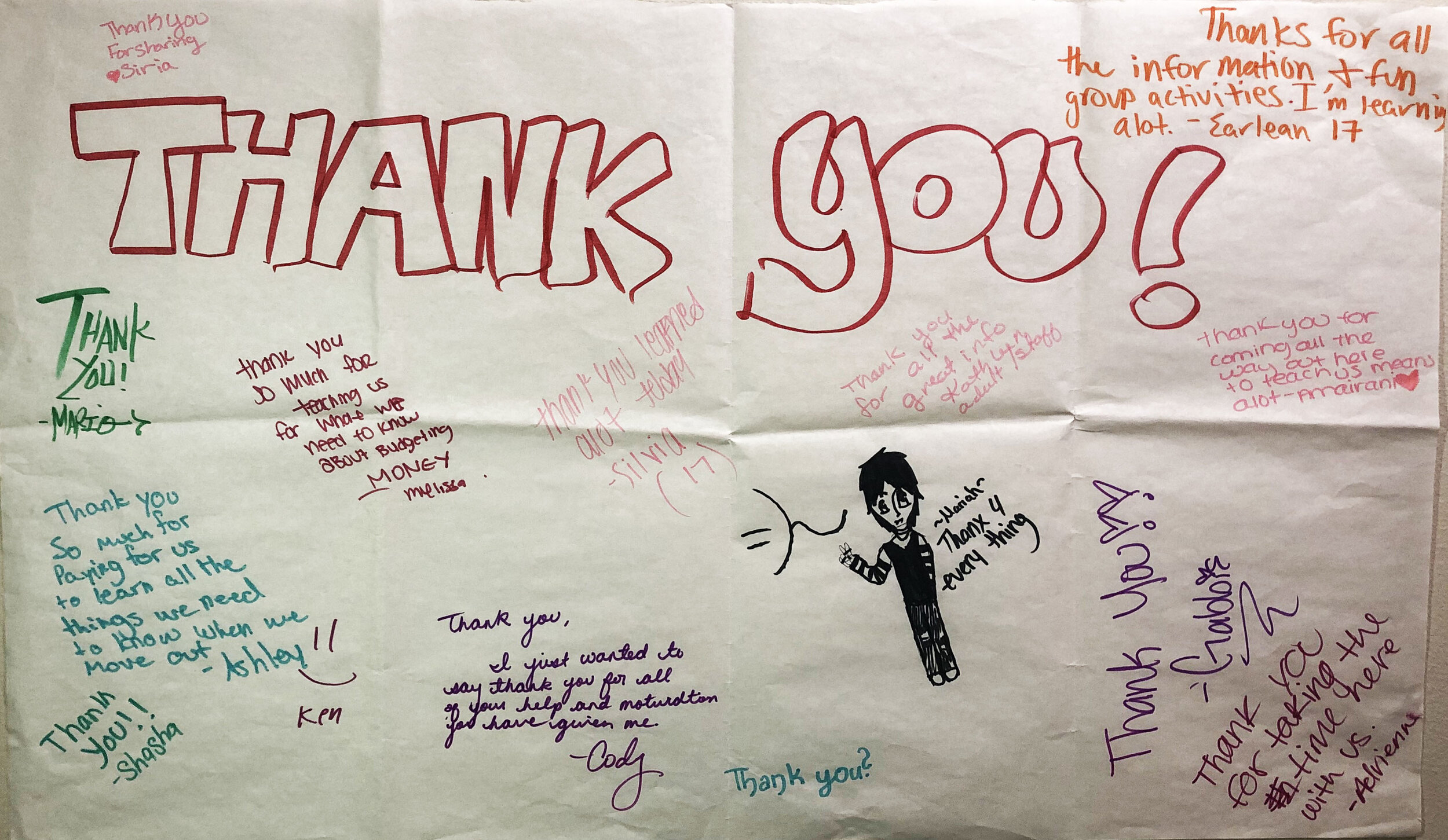

What communities are saying:

Download an Activity

POCKETS CHANGE: Battle for the End of the Line

An improv game that uses context, rhythm, freestyle rap, and crowd control to effectively & predictably communicate ideas.